CINCINNATI – The E.W. Scripps Company (NASDAQ: SSP) delivered $616 million in revenue for the fourth quarter of 2023. Loss attributable to the shareholders of Scripps was $268 million or $3.17 per share. A non-cash goodwill impairment charge and restructuring costs for the quarter accounted for $3.15 of the per-share loss.

Business notes:

From Scripps President and CEO Adam Symson:

“Our fourth-quarter results reflect improvement in the advertising marketplace, both at the core local level and nationally. In Local Media, we saw our five top categories end the quarter higher than Q4 2022, with particular strength in auto, home improvement and services. Distribution revenue from cable, satellite and virtual providers was up 22% in the fourth quarter.

“In the Scripps Networks segment, our better-than-expected Q4 results came from the build-back of direct response advertising on our linear streams, aligned with lower inflation and positive consumer spending trends. In addition, we continue to meaningfully grow our networks’ connected TV revenue and distribution, including launching ION on Pluto. Fourth-quarter CTV revenue was up 33% after factoring out the programmatic product we are sunsetting.

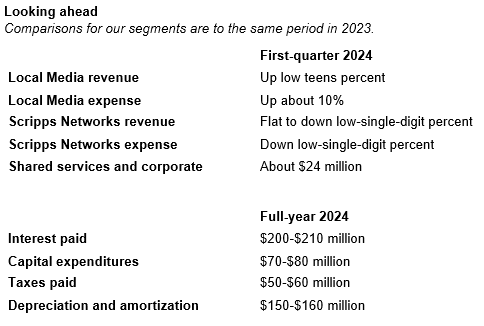

“These positive trends in Local Media and Scripps Networks have continued into the first quarter. Our top four local core categories – services, auto, retail and home improvement – are all up in February. On the networks side, the weak upfront season last year left us with less of a revenue foundation than usual for the first quarter. However, direct response advertising has held steady in Q1, and connected TV revenue is building and on track to grow more than 40% for the full year, minus the programmatic product.

“Our advertising revenue results and large distribution ecosystem, combined with our cost-savings initiatives, lay the groundwork for short-term operating performance improvement and firm financial footing as we execute on strategies for future growth. We are planning for a near-term media landscape where consumers combine a variety of connected TV services with free, over-the-air viewing that best serves their desire to watch live sports, news and television entertainment events. We also are moving aggressively ahead with datacasting business models and expect to take in first dollars this year. We are carving out a valuable and durable niche in the chaos around us.”

Operating results

Total fourth-quarter company revenue was $616 million, a decrease of 9.6% or $65.2 million from the prior-year quarter, which held a midterm election. Costs and expenses for segments, shared services and corporate were $503 million, up from $477 million in the year-ago quarter.

Loss attributable to the shareholders of Scripps was $268 million or $3.17 per share. Pre-tax costs for the quarter included a non-cash goodwill impairment charge for Scripps Networks of $266 million as well as a $9.4 million restructuring charge, increasing the loss attributable to the shareholders by $3.15 per share. In the prior-year quarter, income attributable to the shareholders was $73 million or 84 cents per share and included a $7.4 million pre-tax gain on extinguishment of debt from the redemption of senior notes, which increased income attributable to the shareholders by 7 cents per share.

Fourth-quarter 2023 results by segment compared to prior-period amounts:

Local Media

Revenue was $381 million, down 12% from the prior-year quarter.

Segment expenses increased 4.8% to $295 million. Programming costs in 2023 reflect additional expense attributed to the new Vegas Golden Knights and Arizona Coyotes sports rights agreements.

Segment profit was $85.7 million, compared to $152 million in the year-ago quarter.

Scripps Networks

Revenue was $230 million, down 7.1% from the prior-year quarter. Segment expenses were $166 million, down 1.2%, reflecting a decrease in costs from the programmatic product we are sunsetting.

Segment profit was $64.3 million, compared to $80 million in the year-ago quarter.

Financial condition

On Dec. 31, cash and cash equivalents totaled $35.3 million, and total debt was $3 billion.

During 2023, we made mandatory principal payments of $17.1 million on our term loans.

On July 31, the company amended its credit facility to increase our revolver borrowing capacity by $185 million to $585 million. We used borrowings on the revolver to pay down the remaining $283 million balance of our term loan maturing in 2024.

Preferred stock dividends paid in 2023 were $48 million. Under the terms of Berkshire Hathaway’s preferred equity investment in Scripps, we are prohibited from paying dividends on or repurchasing our common shares until all preferred shares are redeemed. In February 2024, we notified the preferred share holder of our intent to not declare the first-quarter 2024 dividend. We currently have sufficient liquidity to pay the scheduled dividends on the preferred shares; however, this action provides us better flexibility for accelerating deleveraging and maximizing the paydown of our traditional bank debt.

Year-to-date operating results

The following comparisons are to the period ending Dec. 31, 2023:

Total 2023 company revenue was $2.3 billion, which compares to revenue of $2.5 billion in 2022. Political revenue was $33.5 million, compared to $208 million in the prior year, an election year.

Costs and expenses for segments, shared services and corporate of $1.9 billion remained relatively flat compared to a year ago.

Loss attributable to the shareholders of Scripps was $998 million or $11.84 per share. Pre-tax costs for the 2023 period included a non-cash goodwill impairment charge for Scripps Networks of $952 million as well as $38.6 million of restructuring charges, increasing the loss attributable to the shareholders by $11.36 per share. In the prior year, income attributable to the shareholders was $146 million or $1.62 per share. Pre-tax costs for the prior year included $1.6 million of acquisition and related integration costs as well as an $8.6 million gain on extinguishment of debt for the redemption of senior notes. These items increased income attributable to the shareholders by 6 cents per share.

Conference call

The senior management of The E.W. Scripps Company will discuss the company’s quarterly results during a telephone conference call at 9:30 a.m. Eastern today. To access the live webcast, visit Scripps – Investor Information and find the link under “upcoming events.”

To access the conference call by telephone, dial (844) 867-6169 (U.S.) or (409) 207-6975 (international) and

give the access code 5890648 approximately five minutes before the start of the call. Investors and analysts will

need the name of the call (“Scripps earnings call”) to be granted access. The public is granted access to the

conference call on a listen-only basis.

A replay line will be open from 12:30 p.m. Eastern time Feb. 23 until midnight March 24. The domestic number to access the replay is (866) 207-1041 and the international number is (402) 970-0847. The access code for both numbers is 4751031.

A replay of the conference call will be archived and available online for an extended period of time following the

call. To access the audio replay, visit Scripps – Investor Information approximately four hours after the call, and the link

can be found on that page under “audio/video links.”

Forward-looking statements

This document contains certain forward-looking statements related to the company’s businesses that are based on management’s current expectations. Forward-looking statements are subject to certain risks, trends and uncertainties, including changes in advertising demand and other economic conditions that could cause actual results to differ materially from the expectations expressed in forward-looking statements. Such forward-looking statements are made as of the date of this document and should be evaluated with the understanding of their inherent uncertainty. A detailed discussion of principal risks and uncertainties that may cause actual results and events to differ materially from such forward-looking statements is included in the company’s Form 10-K, on file with the SEC, in the section titled “Risk Factors.” The company undertakes no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date such statements are made.

Media contact: Michael Perry, The E.W. Scripps Company, (513) 259-4718, [email protected]

Investor contact: Carolyn Micheli, The E.W. Scripps Company, (513) 977-3732, [email protected]