CINCINNATI – The E.W. Scripps Company (NASDAQ: SSP) delivered $728 million in revenue for the fourth quarter of 2024, driven by record political advertising revenue. Income attributable to the shareholders of Scripps was $80.3 million or 92 cents per share.

Business notes:

From Scripps President and CEO Adam Symson:

“We are pleased to be announcing a significant round of debt refinancing. Our highest priority remains reducing our total amount of debt and improving the company’s leverage with a focus that is already yielding significant results. Our record political advertising revenue and strategic expense management helped drive down our leverage significantly, to 4.8x, at year-end 2024. That is nearly a full turn below year-end 2023 levels.

“We also continue to make strong progress toward improving our financial performance. Company leaders and I are determined to continue this work as we move through 2025. We are on track, as we laid out in November, to increase the Scripps Networks division margin by at least 400-600 basis points this year. Further, enterprise-wide, we are executing a transformation plan to improve operating performance as we best position Scripps to create new value.

“Industrywide, we anticipate changes to the local broadcast regulatory environment under the new leadership at the Federal Communications Commission. We’re pleased with the signals that the commission will revisit outdated ownership rules that have constrained economic growth and jeopardized broadcasters’ ability to serve their audiences and local communities. We will lean into any opportunity to improve the operating performance of the company, deepen our connection to the communities we serve and unlock shareholder value.”

Operating results

Fourth-quarter company revenue was $728 million, an increase of 18% or $113 million from the prior-year quarter. Costs and expenses for segments, shared services and corporate were $502 million, down from $503 million in the year-ago quarter.

Income attributable to the shareholders of Scripps was $80.3 million or 92 cents per share. The quarter included a $19.2 million gain from the sale of transmission tower sites, a $15 million non-cash impairment loss for an investment write-off and a $14.9 million restructuring charge, decreasing the income attributable to shareholders by 9 cents per share. In the prior-year quarter, the loss attributable to shareholders was $268 million or $3.17 per share. The pre-tax costs for the prior-year quarter included a non-cash goodwill impairment charge for Scripps Networks of $266 million as well as a $9.4 million restructuring charge, increasing the loss attributable to shareholders by $3.15 per share.

Fourth-quarter 2024 results by segment compared to prior-period amounts:

Local Media

Revenue was $511 million, up 34% from the prior-year quarter.

Segment expenses increased 5.7% to $312 million.

Segment profit was $199 million, compared to $85.7 million in the year-ago quarter.

Scripps Networks

Revenue was $216 million, down 6.1% from the prior-year quarter. Segment expenses were $155 million, down 6.3%.

Segment profit was $60.7 million, compared to $64.3 million in the year-ago quarter.

Financial condition

On Dec. 31, cash and cash equivalents totaled $23.9 million, and total debt was $2.6 billion.

During 2024, we paid off the $330 million revolving credit facility balance. There were no borrowings under our revolving credit facility at Dec. 31. We made mandatory principal payments of $15.6 million on our term loans during 2024.

We did not declare or provide payment for any of the 2024 quarterly preferred stock dividends. Deferral of preferred stock dividend payments provides us better flexibility for accelerating deleveraging and maximizing the paydown of our traditional bank debt. The dividend rate on the preferred shares, which compounds quarterly, increased to 9% per annum and will remain at that rate. At Dec. 31, aggregated undeclared and unpaid cumulative dividends totaled $55.8 million. Under the terms of Berkshire Hathaway’s preferred equity investment in Scripps, we are prohibited from paying dividends on or repurchasing our common shares until all preferred shares are redeemed.

Year-to-date operating results

The following comparisons are to the period ending Dec. 31, 2023:

Revenue was $2.5 billion, which compares to revenue of $2.3 billion in 2023. Political revenue was $363 million, compared to $33.5 million in the prior year, a non-election year.

Costs and expenses for segments, shared services and corporate were $1.9 billion, relatively flat from the year-ago period.

Income attributable to the shareholders of Scripps was $87.6 million or $1.01 per share. The current year included a $19.2 million gain from the sale of tower sites, an $18.1 million investment gain, a $33.5 million restructuring charge and a $15 million non-cash impairment loss for an investment write-off, decreasing the income attributable to shareholders by 10 cents per share. In the prior year, loss attributable to shareholders was $998 million or $11.84 per share. Pre-tax costs for the prior year included a non-cash goodwill impairment charge for Scripps Networks of $952 million as well as a $38.6 million restructuring charge, increasing the loss attributable to shareholders by $11.36 per share.

Looking ahead

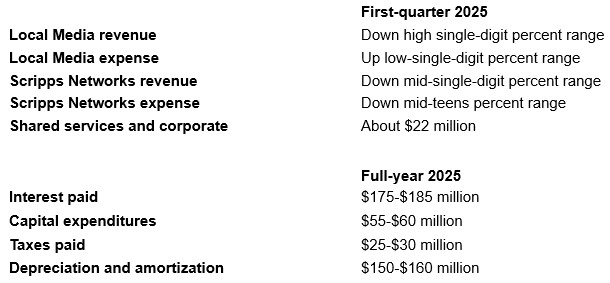

Comparisons for our segments are to the same period in 2024.

Conference call

Scripps’ senior management team will host a call about financial results at 9 a.m. Eastern time on Wednesday, March 12.

Due to a change in Scripps’ conference call provider, the company has a new protocol for joining its earnings calls:

A replay of the conference call will be archived and available online for an extended period of time. To access the audio replay, visit http://ir.scripps.com/ approximately four hours after the call, and the link can be found on that page under “audio/video links.”

Forward-looking statements

This document contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “believe,” “anticipate,” “intend,” “expect,” “estimate,” “could,” “should,” “outlook,” “guidance,” and similar references to future periods. Examples of forward-looking statements include, among others, statements the company makes regarding expected operating results and future financial condition. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations, and assumptions regarding the future of the industry and the economy, the company’s plans and strategies, anticipated events and trends, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties, and changes in circumstance that are difficult to predict and many of which are outside of the company’s control. The company’s actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause the company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: change in advertising demand, fragmentation of audiences, loss of affiliation agreements, loss of distribution revenue, increase in programming costs, changes in law and regulation, the company’s ability to identify and consummate strategic transactions, the controlled ownership structure of the company, and the company’s ability to manage its outstanding debt obligations. A detailed discussion of such risks and uncertainties is included in the company’s Form 10-K, on file with the SEC, in the section titled “Risk Factors.” Any forward-looking statement made in this document is based only on currently available information and speaks only as of the date on which it is made. The company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

Contact: Carolyn Micheli, The E.W. Scripps Company, [email protected]

About Scripps

The E.W. Scripps Company (NASDAQ: SSP) is a diversified media company focused on creating a better-informed world. As one of the nation’s largest local TV broadcasters, Scripps serves communities with quality, objective local journalism and operates a portfolio of more than 60 stations in 40+ markets. Scripps reaches households across the U.S. with national news outlets Scripps News and Court TV and popular entertainment brands ION, Bounce, Grit, ION Mystery, ION Plus and Laff. Scripps is the nation’s largest holder of broadcast spectrum. Scripps is the longtime steward of the Scripps National Spelling Bee. Founded in 1878, Scripps’ long-time motto is: “Give light and the people will find their own way.”