CINCINNATI – The E.W. Scripps Company (NASDAQ: SSP) delivered $526 million in revenue for the third quarter of 2025. Loss attributable to the shareholders of Scripps was $49 million or 55 cents per share.

Business notes:

From Scripps President and CEO Adam Symson:

“We are pleased today to report a third consecutive quarter of meeting or exceeding Wall Street expectations on nearly every reporting line. In addition, we completed a significant refinancing and brought down our leverage ratio from the start of the year. Since early August, we have announced the sale of two stations at valuations well above the industry average, contributing to improving the health of our balance sheet and the durability of our Local Media portfolio and further de-levering.

“Expense discipline is an important part of our success story. In the third quarter alone, we reduced expenses by more than 4% in Local Media and 7.5% in Scripps Networks. Employee costs came down in both divisions. In Local Media, we held network compensation flat over last Q3, and in Networks, we’re seeing the ongoing effect of reductions in our Scripps News operations last fall. As a result of our initiatives, our Networks margins have exceeded our original guidance of 400-600 basis-point improvement for three straight quarters.

“All of these financial milestones should serve as clear evidence that our short-term performance improvement and near-term growth strategies we have been executing, many of them unique among local broadcast groups, are working: launching sports partnerships and programming for business growth; optimizing the performance of our portfolio at premium seller multiples; improving our networks margins; and embracing artificial intelligence and other technologies to create efficiencies across the enterprise. These strategies will help Scripps thrive, driving business growth by creating connection through our local news and network programming in our geographic and audience communities from coast to coast.”

Operating results

Third-quarter company revenue was $526 million, a decrease of 19% or $120 million from the prior-year quarter. Costs and expenses for segments, shared services and corporate were $449 million, down from $472 million in the year-ago quarter.

Loss attributable to the shareholders of Scripps was $49 million or 55 cents per share. The current-year quarter included a $7.6 million loss on extinguishment of debt, $6.5 million of financing transaction costs, a $1.4 million write-off of deferred financing costs and $2.7 million in restructuring costs. When taken together, these items increased the loss attributable to shareholders by 15 cents per share. In the prior-year quarter, income attributable to shareholders of Scripps was $33 million or 37 cents per share. The pre-tax costs for the prior-year quarter included a $12.7 million restructuring charge, decreasing the income attributable to shareholders by 11 cents per share.

Third-quarter 2025 results by segment compared to prior-period amounts:

Local Media

Revenue was $325 million, down 27% from the prior-year quarter.

Segment expenses decreased 4.3% to $273 million.

Segment profit was $52.8 million, compared to $161 million in the year-ago quarter.

Scripps Networks

Revenue was $201 million, down 0.4% from the prior-year quarter. Segment expenses were $148 million, down 7.5% from the prior-year quarter.

Segment profit was $53.3 million, compared to $42.1 million in the year-ago quarter.

Financial condition

On Sept. 30, cash and cash equivalents totaled $54.7 million, and total debt was $2.7 billion.

At Sept. 30, long-term debt included $1.7 billion of senior notes outstanding, $676 million of term loans outstanding and $360 million under the accounts receivable securitization facility, which was the maximum availability allowed. Additionally, no borrowings were outstanding under revolving credit facilities. During the first nine months of 2025, $1.6 billion in proceeds were received from the issuance of new long-term debt. On April 10, 2025, the company issued a new $545 million tranche B-2 term loan that matures in June 2028 and a new $340 million tranche B-3 term loan that matures in November 2029. On Aug. 6, 2025, $750 million of senior secured second-lien notes were issued that mature in August 2030. During the first nine months of 2025, payments on long-term debt totaled $1.9 billion, which included $1.3 billion to pay down term loans that were due to mature in May 2026 and January 2028, $426 million to redeem outstanding principal amount of the senior unsecured notes due to mature in July 2027 and a $205 million pre-payment on the term loan due to mature in June 2028.

Scripps did not declare or provide payment for any of the 2025 quarterly preferred stock dividends. The 9% dividend rate on the preferred shares compounds quarterly. At Sept. 30, aggregated undeclared and unpaid cumulative dividends totaled $101 million. Under the terms of Berkshire Hathaway’s preferred equity investment in Scripps, the company is prohibited from paying dividends on or repurchasing common shares until all preferred shares are redeemed.

Year-to-date operating results

The following comparisons are to the period ending Sept. 30, 2024:

Revenue was $1.6 billion, a decrease of 11% or $191 million from the prior year. Political revenue was $11.9 million compared to $177 million in the prior year, an election year. Costs and expenses for segments, shared services and corporate were $1.4 billion in 2025 and 2024.

Loss attributable to the shareholders of Scripps was $120 million or $1.36 per share. The 2025 period included $44.5 million of financing transaction costs, a $31.4 million gain on our West Palm television station building sale, a $10.6 million loss on extinguishment of debt, $7.5 million in restructuring costs and a $7 million write-off of deferred financing costs. When taken together, these items increased the loss attributable to shareholders by 33 cents per share. In the prior year, income attributable to the shareholders of Scripps was $7.3 million or 8 cents per share. The 2024 period included an $18.1 million investment gain and an $18.7 million restructuring charge.

Looking ahead

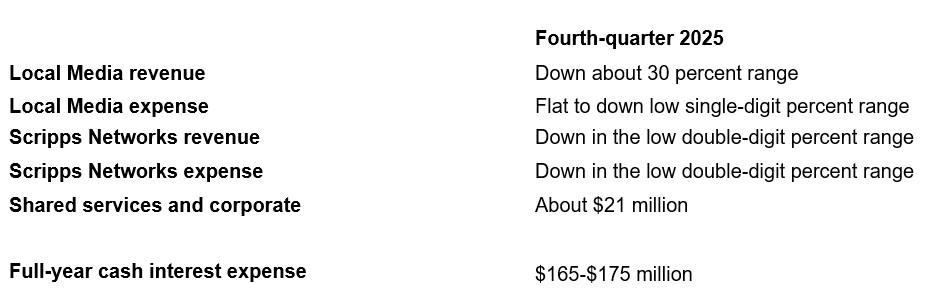

Comparisons for our segments are to the same period in 2024.

Conference call

The company’s senior management team will hold a call to discuss third-quarter 2025 results at 9:30 a.m. Eastern time on Friday, Nov. 7.

The company’s protocol for joining its earnings calls is as follows:

A replay of the conference call will be archived and available online for an extended period of time. To access the audio replay, visit http://ir.scripps.com/ approximately four hours after the call, and the link can be found on that page under “audio/video links.”

Contact: Carolyn Micheli, The E.W. Scripps Company, (513) 977-3732, [email protected]

Forward-looking statements

This document contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “believe,” “anticipate,” “intend,” “expect,” “estimate,” “could,” “should,” “outlook,” “guidance,” and similar references to future periods. Examples of forward-looking statements include, among others, statements the company makes regarding expected operating results and future financial condition. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations, and assumptions regarding the future of the industry and the economy, the company’s plans and strategies, anticipated events and trends, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties, and changes in circumstance that are difficult to predict and many of which are outside of the company’s control. The company’s actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause the company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: change in advertising demand, fragmentation of audiences, loss of affiliation agreements, loss of distribution revenue, increase in programming costs, changes in law and regulation, the company’s ability to identify and consummate strategic transactions, the controlled ownership structure of the company, and the company’s ability to manage its outstanding debt obligations. A detailed discussion of such risks and uncertainties is included in the company’s Form 10-K, on file with the SEC, in the section titled “Risk Factors.” Any forward-looking statement made in this document is based only on currently available information and speaks only as of the date on which it is made. The company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

About Scripps

The E.W. Scripps Company (NASDAQ: SSP) is a diversified media company focused on creating connection. As one of the nation’s largest local TV broadcasters, Scripps serves communities with quality, objective local journalism and operates a portfolio of more than 60 stations in 40+ markets. Scripps reaches households across the U.S. with national news outlets Scripps News and Court TV and popular entertainment brands ION, ION Plus, ION Mystery, Bounce, Grit and Laff. Scripps is the nation’s largest holder of broadcast spectrum. Scripps Sports serves professional and college sports leagues, conferences and teams with local market depth and national broadcast reach of up to 100% of TV households. Founded in 1878, Scripps is the steward of the Scripps National Spelling Bee, and its longtime motto is: “Give light and the people will find their own way.”