Political ad revenue was the highest-ever for second quarter; company is on track for record full-year political results

CINCINNATI – The E.W. Scripps Company (NASDAQ: SSP) delivered $594 million in revenue and $132 million in segment profit for the second quarter of 2022, driven by higher Local Media political advertising and retransmission revenues.

The company is on track to deliver at least $270 million of Local Media political advertising revenue for the full year, outpacing its 2020 adjusted-combined presidential election year political revenue, after record-setting second-quarter results.

Highlights:

“For the second quarter, Scripps met or exceeded overall expectations. Foreshadowing the record performance we expect in the back half of the year, political advertising during the first two quarters nearly equaled the level of revenue we saw for the same period of the presidential election year 2020, when Michael Bloomberg spent early and heavily in our markets to promote his presidential campaign. We also experienced smaller declines in our pay TV subscriber household counts year over year,” said Adam Symson, Scripps president and CEO.

“While Scripps Networks revenue was short of guidance – a reflection of the weakness in the national ad market – it still equaled last year’s extraordinary performance and delivered results better than peers as well as a margin of more than 30%.”

“The Networks benefited from growth in connected TV revenue, with continued momentum expected in the back half of the year. By the end of the third quarter, most of our Scripps networks will be nearly fully distributed across connected TV platforms, and our previous CTV launches this year are garnering significant viewing, driving the increases in CTV revenue. Our networks also are available on cable and satellite and to nearly every U.S. television household through over-the-air broadcast.

“The Scripps strategy is to deliver quality programs to media consumers on their preferred TV viewing platforms – an all-of-the-above distribution approach that is paying dividends as Scripps establishes itself as a leader in free, ad-supported television.”

Operating results

Total second-quarter company revenue was $594 million, an increase of 5.2% or $29.4 million from the prior-year quarter due to higher political and retransmission revenue in our Local Media division.

Costs and expenses for segments, shared services and corporate were $463 million, up from $413 million in the year-ago quarter.

Income attributable to the shareholders of Scripps was $29.2 million or 32 cents per share. In the prior-year quarter, the company had reported a loss from continuing operations attributable to its shareholders of $11.4 million or 14 cents per share. The prior-year quarter included a $13.8 million loss on extinguishment of debt from the redemption of our 2025 senior notes, a $31.9 million non-cash adjustment due to the increase in the fair value of the outstanding common stock warrant liability, acquisition and related integration costs of $6.7 million, and $514,000 of restructuring costs. These items decreased income from continuing operations by $47.6 million, net of taxes, or 58 cents per share.

Second-quarter 2022 results by segment compared to prior-period amounts:

Local Media

Revenue from Local Media was $356 million, up 9.5% from the prior-year quarter.

Segment expenses increased 5.7% to $275 million, driven by network affiliation fees and the impact of Scripps employees returning to working in its station buildings, resuming more normal operating procedures.

Segment profit was $80.7 million, compared to $64.6 million in the year-ago quarter.

Scripps Networks

Revenue from Scripps Networks was $239 million, equal to the prior-year quarter. Incremental ad revenue earned from the July 2021 launch of Defy TV and TrueReal networks was offset by weakness in the national advertising market.

Segment expenses for Scripps Networks increased 26% to $166 million, consistent with the company’s strategic commitment to new national networks launches and continued programming improvements.

Segment profit was $73.3 million, compared to $107 million in the year-ago quarter.

Financial condition

On June 30, cash and cash equivalents totaled $58.2 million and total debt was $3.1 billion, including $60 million outstanding under our revolving credit facility.

During the first quarter of 2022, we redeemed a total of $123 million of the outstanding principal on our senior notes. In addition, we made mandatory principal payments of $9.3 million on our term loans during the first half of the year.

Preferred stock dividends paid in 2022 were $24 million. Under the terms of Berkshire Hathaway’s preferred equity investment in Scripps, we are prohibited from paying dividends on or repurchasing our common shares until all preferred shares are redeemed.

Year-to-date operating results

The following comparisons are to the period ending June 30, 2021:

In 2022, revenue was $1.2 billion, which compares to revenue of $1.1 billion in 2021. Political revenue was $30.8 million, compared to $4.5 million in the prior year.

Costs and expenses for segments, shared services and corporate were $913 million, up from $821 million in the year-ago period, reflecting costs attributed to our recent over-the-air network launches, continued investment in programming, higher affiliation fees and the impact of Scripps employees returning to working in its stations and offices.

Income from continuing operations attributable to the shareholders of Scripps was $39 million or 42 cents per share. Pre-tax costs for the 2022 period included $1.6 million of acquisition and related integration costs as well as a $1.2 million gain on extinguishment of debt from the redemption of senior notes. In the prior-year period, loss from continuing operations attributable to the shareholders of Scripps was $19.5 million or 24 cents per share. Pre-tax costs for the prior year included an $81.8 million gain from the sale of Triton, a $13.8 million loss on extinguishment of debt, a $99.1 million non-cash adjustment due to the increase in the fair value of the outstanding common stock warrant liability, acquisition and related integration costs of $35.3 million and $7.6 million of restructuring costs. These items decreased income from continuing operations by $76.9 million, net of taxes, or 94 cents per share.

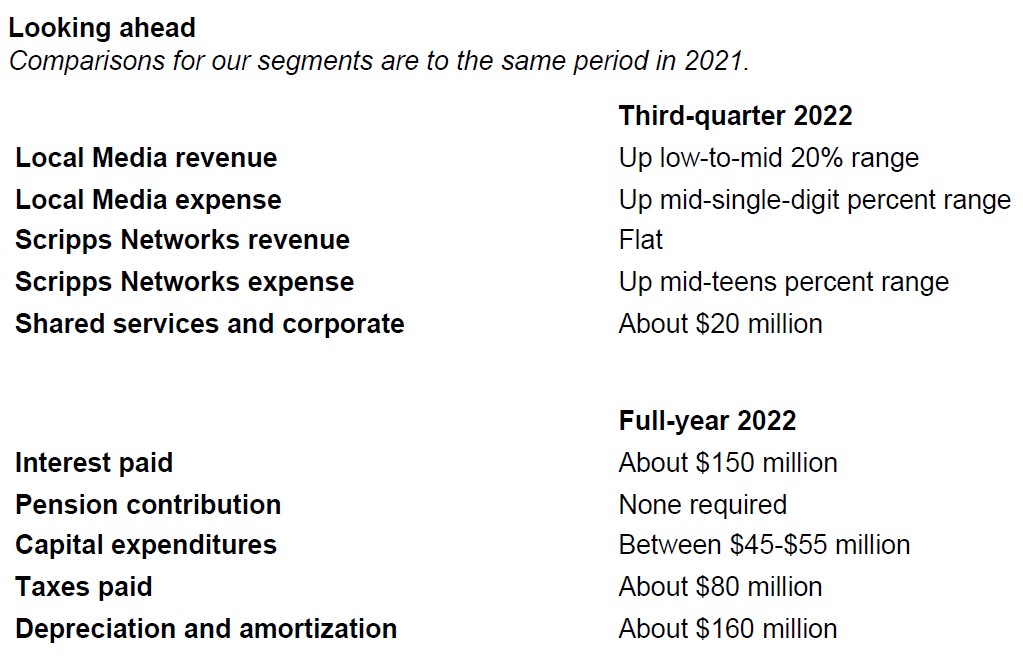

Looking ahead

Comparisons for our segments are to the same period in 2021.

Conference call

The senior management of The E.W. Scripps Company will discuss the company’s quarterly results during a telephone conference call at 9:30 a.m. Eastern today. To access the live webcast, visit http://ir.scripps.com and find the link under “upcoming events.”

To access the conference call by telephone, dial (844) 867-6169 (U.S.) or (409) 207-6975 (international) and give the access code 1864935 approximately five minutes before the start of the call. Investors and analysts will need the name of the call (“Scripps earnings call”) to be granted access. The public is granted access to the conference call on a listen-only basis.

A replay line will be open from 1:30 p.m. Eastern time Aug. 5 until midnight Sept. 7. The domestic number to access the replay is (866) 207-1041 and the international number is (402) 970-0847. The access code for both numbers is 4808441.

A replay of the conference call will be archived and available online for an extended period of time following the call. To access the audio replay, visit http://ir.scripps.com/ approximately four hours after the call, and the link can be found on that page under “audio/video links.”

Forward-looking statements

This document contains certain forward-looking statements related to the company’s businesses that are based on management’s current expectations. Forward-looking statements are subject to certain risks, trends and uncertainties, including changes in advertising demand and other economic conditions that could cause actual results to differ materially from the expectations expressed in forward-looking statements. Such forward-looking statements are made as of the date of this document and should be evaluated with the understanding of their inherent uncertainty. A detailed discussion of principal risks and uncertainties, including those engendered by the COVID-19 pandemic, that may cause actual results and events to differ materially from such forward-looking statements is included in the company’s Form 10-K, on file with the SEC, in the section titled “Risk Factors.” The company undertakes no obligation to publicly update any forward-looking statements to reflect events or circumstances after the date such statements are made.

Contact:

Carolyn Micheli, The E.W. Scripps Company, 513-977-3732, [email protected]

About Scripps

The E.W. Scripps Company (NASDAQ: SSP) is a diversified media company focused on creating a better-informed world. As one of the nation’s largest local TV broadcasters, Scripps serves communities with quality, objective local journalism and operates a portfolio of 61 stations in 41 markets. The Scripps Networks reach nearly every American through the national news outlets Court TV and Newsy and popular entertainment brands ION, Bounce, Grit, Laff, ION Mystery, Defy TV and TrueReal. Scripps is the nation’s largest holder of broadcast spectrum. Scripps runs an award-winning investigative reporting newsroom in Washington, D.C., and is the longtime steward of the Scripps National Spelling Bee. Founded in 1878, Scripps has held for decades to the motto, “Give light and the people will find their own way.”